The Complete Guide to US Gambling Taxes

US Gambling Taxes

US Gambling Taxes

- Navigating Taxes on Casino Winnings

- Online Gambling Taxes: A Beginner’s Guide

- Tax-Free States

- States with Low Gambling Taxes

- Federal Taxes on Gambling

- Turning Losses into Deductions

- Frequently Asked Questions

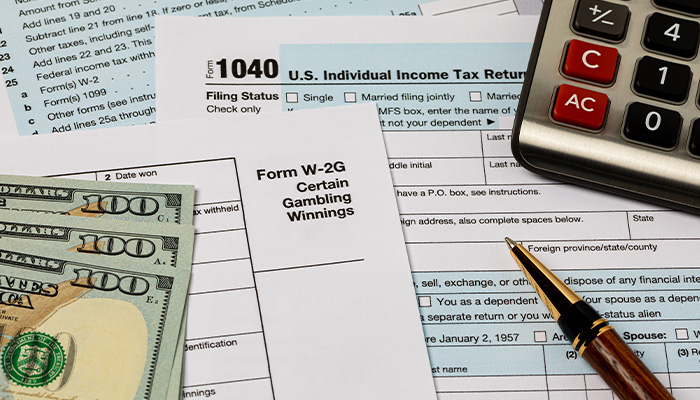

Gambling winnings are subject to both federal and state taxes in most parts of the United States. However, some states do not tax gambling winnings or have very low tax rates compared to others. This guide will overview gambling and casino taxes by state, so you can choose where to play based on favorable tax laws.

Navigating Taxes on Casino Winnings

Whether you have to pay taxes on casino winnings depends on several factors. However, the most important is the state that you’re playing in. At the time of writing, nine US states including Nevada, Wyoming, and Florida do not tax gambling winnings at all.

Other states like Arizona, North Dakota, Indiana, and Pennsylvania have relatively low tax rates between 2-4% on casino, sports betting, and other gambling winnings. However, it’s important to remember that the federal government taxes gambling income at 24% in every state, so you can never fully avoid taxes on those big wins!

Online casinos in the US work in the same way – so don’t assume that just because you’re playing online means you don’t need to worry about paying taxes. Taxes on online poker winnings are calculated in the same way as other forms of online gambling. Make sure you play at one of the best US online casinos and poker sites we recommend here on our site.

Online Gambling Taxes: A Beginner’s Guide

Online gambling taxes can seem like a pretty complex topic at first. Contrary to what many people believe, online gambling winnings are considered taxable income by the IRS, even if you play on offshore sites operating illegally in the US.

By law, you must report all gambling income on your federal tax return and pay a flat 24% tax rate regardless of your total earnings. Some key things to know about taxes for US online gamblers:

- Offshore gambling sites do not issue tax forms like W-2Gs. However, you still need to accurately report winnings yourself. Keep detailed records of both wins and losses from each gambling session.

- Losses can be deducted to offset winnings, but only up to the amount you won. Keep all betting slips, statements, and other documentation in case of an audit.

- Never assume you can avoid declaring online gambling income since it was earned illegally. Tax evasion can lead to civil and criminal penalties. The IRS cares about collecting revenue, not how you earned it.

- Consider making quarterly estimated tax payments on gambling income to avoid underpayment penalties. Especially if you don’t have taxes withheld from other sources like a job.

- Be sure to check if your state taxes gambling winnings in addition to federal taxes. Most states, like New Jersey and Pennsylvania, do levy their own tax on online and offline gambling income.

- Getting paid through electronic methods like e-wallets complicates documentation. Withdrawals from PayPal or Neteller alone don’t prove losses. Keep detailed records.

If you’re a professional gambler, you are advised to always report income and losses on a Schedule C instead of the “Other Income” form. However, in doing so, you will be subjecting your winnings to self-employment tax.

While offshore online gambling sites allow you to play anonymously, according to the IRS, you still have to pay your fair share in taxes. Consult a tax professional if you have questions or complex gambling income and loss situations to report – and please, don’t take this blog as legal advice. Laws vary a lot depending on the state you’re playing in, so always keep this in mind.

Tax-Free States

Taxes on gambling is a complex subject in the US. Not only do some states levy a gambling tax, but you’re also subject to federal income tax. However, there are several states without any gambling tax, as shown in the table below:

| State | Relevant Information |

|---|---|

| Alaska | Offers legal casino cruise ships, bingo, pull tabs, and no state taxes on winnings. |

| Delaware | Home to three racinos and doesn’t tax gambling winnings. |

| Florida | Features tribal casinos, poker rooms, racetracks, and no state tax on gambling winnings. |

| Nevada | Boasts over 440 casinos, with no state taxes on gambling winnings. |

| New Hampshire | Offers charity casinos and sportsbooks without taxing gambling winnings. |

| South Dakota | Contains 45 casinos, mainly in Deadwood, and doesn’t tax gambling winnings. |

| Texas | Provides a few casinos (Class II only), horse tracks, charity gaming venues, with no state taxes on winnings. |

| Washington | Offers tribal casinos, poker rooms, racetracks, and doesn’t tax gambling winnings, despite a harsh stance on online gambling. |

| Wyoming | Provides charity casinos, horse tracks, poker rooms, and doesn’t tax gambling winnings. |

States with Low Gambling Taxes

While not every state offers tax-free gambling, thankfully, there are many that don’t take a huge chunk out of your winnings. A handful of states tax winnings at relatively low rates compared to others. This often means that, in some states near the border, it can be worth crossing state lines to play with lower gambling taxes.

Some low-tax gambling states include Arizona, taking just 4.54% of your wins from tribal casinos, racetracks, and the state lottery. Indiana hits you with just a 3.23% tax across its commercial and tribal casinos, sportsbooks, and regulated online gambling sites. Up north, Michigan levies a 4.25% tax on the numerous tribal and commercial casinos within its borders.

If you find yourself out West, North Dakota taxes gambling income at just 2.90%, the lowest rate of any tax-charging state. This applies to charitable gaming, tribal casinos, and the state lottery. Up in the Northeast, Pennsylvania is home to a growing number of casinos and sportsbooks, but they continue to boast a low taxation rate of just 3.07%.

Federal Taxes on Gambling

When you gamble and win in the United States, there isn’t, unfortunately, any way around paying the IRS, and they tax all gambling income at a 24% flat federal rate, no matter how much you win or what state you play in. So, if you’re lucky enough to hit a jackpot, a big chunk of that cash goes to federal taxes right off the bat!

You need to report all your winnings as “other income” on your federal tax return. Whether it’s jackpots at the casino, a winning sports bet, poker tournaments, lottery prizes, or anything else, the IRS requires an accurate account of every penny you win gambling. If you play at one of the big commercial or tribal casinos, they’ll usually issue you a W-2G form for any slot or video poker wins over $1,200.

For sportsbooks, it kicks in if you win $600 or more on a single bet. The gambling operator sends a copy straight to the IRS, and taxes are usually deducted automatically from your winnings.

Now, where things can get confusing is when it comes to deductions. You can deduct losses from gambling sessions to offset your tax liabilities – but, to do so, you must have rock-hard proof, including betting slips, bank statements, receipts, and so on. These are required so that you can actually prove your losses if you are ever audited. We will look at gambling taxes and deductions in the next section of this blog.

Turning Losses into Deductions

One silver lining about the IRS taxes on casino winnings is that you can deduct losses to offset what you owe. However, you must have ironclad documentation to prove those losses if audited.

You can only deduct losses up to the amount you won in the same tax year. For example, if you lost $5,000 but only won $2,000, your maximum deduction would be $2,000. It’s critical to save all receipts, casino player card records, betting slips, bank and credit card statements, and any other documentation showing your gambling losses. ATM receipts alone won’t cut it as sufficient proof during an audit.

Make sure to record each gambling session’s wins, losses, and expenses like travel costs. Deductible expenses get subtracted on top of losses. You’ll file your gambling deductions on Schedule A of Form 1040 as a miscellaneous itemized deduction. You can’t take the standard deduction if you want to deduct losses.

If you’re a professional gambler, you should report all gambling income and losses on Schedule C instead. However, this subjects your winnings to 15.3% self-employment tax. Also, don’t make the mistake of claiming losses without reporting any winnings. That’s a red flag for auditors, and you must report all gambling income accurately.

Consider keeping a separate gambling-only bank account to simplify tracking wins, losses, and expenses for deduction purposes. And if you have any questions on gambling deductions, talk to a tax professional. Don’t take chances with your taxes as getting audited costs far more than expert advice.